Zenmo is a personal finance software as a service (SaaS) platform that aims to empower users to take control of their financial well-being. It integrates advanced features including AI chatbot support, investment and savings tracking, and personalized watchlists, allowing users to stay well-informed about their spending and savings.

My role

UX/UI Designer

Timeline

3 months

Tools

Figma

Balsamiq

Maze

Challenge

Handling money can be tough because traditional budgeting takes a lot of time and can be confusing. Without the right guidance or personal solutions, it’s easy to overspend and hard to save for both short- and long-term goals. This can make budgeting feel stressful and frustrating.

Results

Through detailed market and user research as well as competitive analysis, I developed a solution: a personal finance platform that addresses common pain points. This platform features an engaging interface and AI chatbot support to provide users with a personalized experience. Users can easily manage their budget through customizable expense categories and automated transaction tracking, while investment and saving trackers promote goal-oriented financial behavior. Customized reports offer valuable insights, and the ability to share progress with family and friends helps individuals stay accountable and inspired to stick to their budgets.

My role

UX/UI Designer

Timeline

3 months

Tools

Figma

Balsamiq

Maze

Challenge

Handling money can be tough because traditional budgeting takes a lot of time and can be confusing. Without the right guidance or personal solutions, it’s easy to overspend and hard to save for both short- and long-term goals. This can make budgeting feel stressful and frustrating.

Results

Through detailed market and user research as well as competitive analysis, I developed a solution: a personal finance platform that addresses common pain points. This platform features an engaging interface and AI chatbot support to provide users with a personalized experience. Users can easily manage their budget through customizable expense categories and automated transaction tracking, while investment and saving trackers promote goal-oriented financial behavior. Customized reports offer valuable insights, and the ability to share progress with family and friends helps individuals stay accountable and inspired to stick to their budgets.

My role

UX/UI Designer

Timeline

3 months

Tools

Figma

Balsamiq

Maze

Challenge

Handling money can be tough because traditional budgeting takes a lot of time and can be confusing. Without the right guidance or personal solutions, it’s easy to overspend and hard to save for both short- and long-term goals. This can make budgeting feel stressful and frustrating.

Results

Through detailed market and user research as well as competitive analysis, I developed a solution: a personal finance platform that addresses common pain points. This platform features an engaging interface and AI chatbot support to provide users with a personalized experience. Users can easily manage their budget through customizable expense categories and automated transaction tracking, while investment and saving trackers promote goal-oriented financial behavior. Customized reports offer valuable insights, and the ability to share progress with family and friends helps individuals stay accountable and inspired to stick to their budgets.

User Research

Semi-structured interview

I started with user interviews, particularly semi-structured interviews to explore some of the psychology of people with money and finances. The target demographic for this study was individuals aged 18 to 40 years old, for whom money plays a significant role in their lives.

Goal of the interview

To understand the relationship with money, The motivation behind saving money, Frustrations while budgeting, Feelings after they overspend or successfully reach their target of saving money, Experience with a budgeting application

The outcome of the interview

The challenges people are facing include a lack of awareness and knowledge about personal finances, motivation, and feeling guilty when overspending, which can hinder budgeting efforts. Additionally, many people struggle with keeping a clear view of their income, expenses, and savings, leading to difficulties in tracking their finances. Lack of accountability also plays a role in hindering their ability to save money.

User Research

Semi-structured interview

I started with user interviews, particularly semi-structured interviews to explore some of the psychology of people with money and finances. The target demographic for this study was individuals aged 18 to 40 years old, for whom money plays a significant role in their lives.

Goal of the interview

To understand the relationship with money, The motivation behind saving money, Frustrations while budgeting, Feelings after they overspend or successfully reach their target of saving money, Experience with a budgeting application

The outcome of the interview

The challenges people are facing include a lack of awareness and knowledge about personal finances, motivation, and feeling guilty when overspending, which can hinder budgeting efforts. Additionally, many people struggle with keeping a clear view of their income, expenses, and savings, leading to difficulties in tracking their finances. Lack of accountability also plays a role in hindering their ability to save money.

User Research

Semi-structured interview

I started with user interviews, particularly semi-structured interviews to explore some of the psychology of people with money and finances. The target demographic for this study was individuals aged 18 to 40 years old, for whom money plays a significant role in their lives.

Goal of the interview

To understand the relationship with money, The motivation behind saving money, Frustrations while budgeting, Feelings after they overspend or successfully reach their target of saving money, Experience with a budgeting application

The outcome of the interview

The challenges people are facing include a lack of awareness and knowledge about personal finances, motivation, and feeling guilty when overspending, which can hinder budgeting efforts. Additionally, many people struggle with keeping a clear view of their income, expenses, and savings, leading to difficulties in tracking their finances. Lack of accountability also plays a role in hindering their ability to save money.

Thematic Analysis

Market research

Overview

The personal finance software market was valued at USD 1.1 billion in 2022 and is estimated to register a CAGR of over 5% between 2023 and 2032.North America contributes to 34% of the global market share. The Monthly Active users (MAU) of the budgeting apps in the US reached 5.2M in July 2022, after hovering around 3M MAU in 2020.

Reason for growth

Awareness of finance management, Rise of convenience, accessible and smart digital tools, Inflation, The rise of fin-fluencers on social media, particularly spreading awareness toward personal finance management, Realization of having enough money to support necessities in hard times or pandemics like COVID.

Opportunity

As awareness of personal finance boosts, people will look for tools that can actively help them manage their finances and give them actionable insights.Very few platforms have features that cover multiple tools of personal finance such as budgeting, investment tracking, and debt management.With the closure of one of the most popular platforms in personal budgeting Mint, People are not able to find an alternative.

Market research

Overview

The personal finance software market was valued at USD 1.1 billion in 2022 and is estimated to register a CAGR of over 5% between 2023 and 2032.North America contributes to 34% of the global market share. The Monthly Active users (MAU) of the budgeting apps in the US reached 5.2M in July 2022, after hovering around 3M MAU in 2020.

Reason for growth

Awareness of finance management, Rise of convenience, accessible and smart digital tools, Inflation, The rise of fin-fluencers on social media, particularly spreading awareness toward personal finance management, Realization of having enough money to support necessities in hard times or pandemics like COVID.

Opportunity

As awareness of personal finance boosts, people will look for tools that can actively help them manage their finances and give them actionable insights.Very few platforms have features that cover multiple tools of personal finance such as budgeting, investment tracking, and debt management.With the closure of one of the most popular platforms in personal budgeting Mint, People are not able to find an alternative.

Market research

Overview

The personal finance software market was valued at USD 1.1 billion in 2022 and is estimated to register a CAGR of over 5% between 2023 and 2032.North America contributes to 34% of the global market share. The Monthly Active users (MAU) of the budgeting apps in the US reached 5.2M in July 2022, after hovering around 3M MAU in 2020.

Reason for growth

Awareness of finance management, Rise of convenience, accessible and smart digital tools, Inflation, The rise of fin-fluencers on social media, particularly spreading awareness toward personal finance management, Realization of having enough money to support necessities in hard times or pandemics like COVID.

Opportunity

As awareness of personal finance boosts, people will look for tools that can actively help them manage their finances and give them actionable insights.Very few platforms have features that cover multiple tools of personal finance such as budgeting, investment tracking, and debt management.With the closure of one of the most popular platforms in personal budgeting Mint, People are not able to find an alternative.

Personal Finance Software Market Size

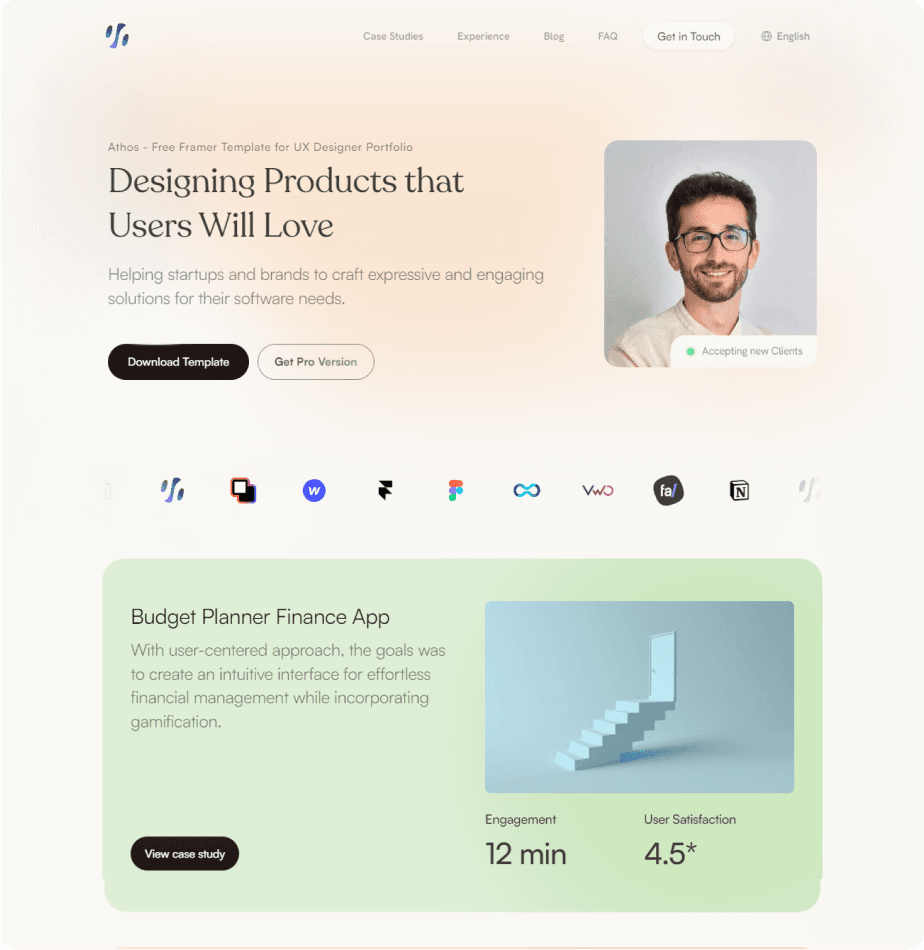

Competitive Analysis

To analyze what the competition is offering and lacking, I have done a competitive analysis of major companies like Quicken, YNAB, EveryDollar, and Monarch.

Competitive Analysis

To analyze what the competition is offering and lacking, I have done a competitive analysis of major companies like Quicken, YNAB, EveryDollar, and Monarch.

Competitive Analysis

To analyze what the competition is offering and lacking, I have done a competitive analysis of major companies like Quicken, YNAB, EveryDollar, and Monarch.

Competitive Analysis Features Comparison table

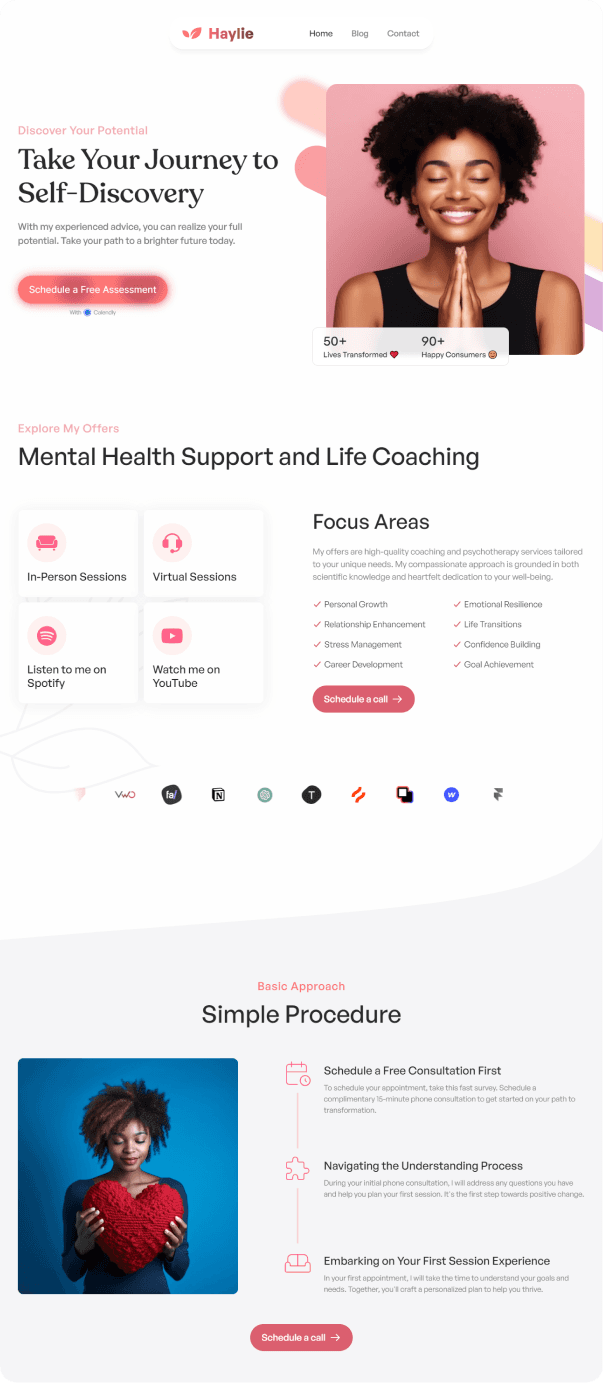

Problem Definition

Personas

Personas helped me understand the pain points more clearly and was able to prioritize the pain points based on their impact on the challenges users were facing.

Problem Definition

Personas

Personas helped me understand the pain points more clearly and was able to prioritize the pain points based on their impact on the challenges users were facing.

Problem Definition

Personas

Personas helped me understand the pain points more clearly and was able to prioritize the pain points based on their impact on the challenges users were facing.

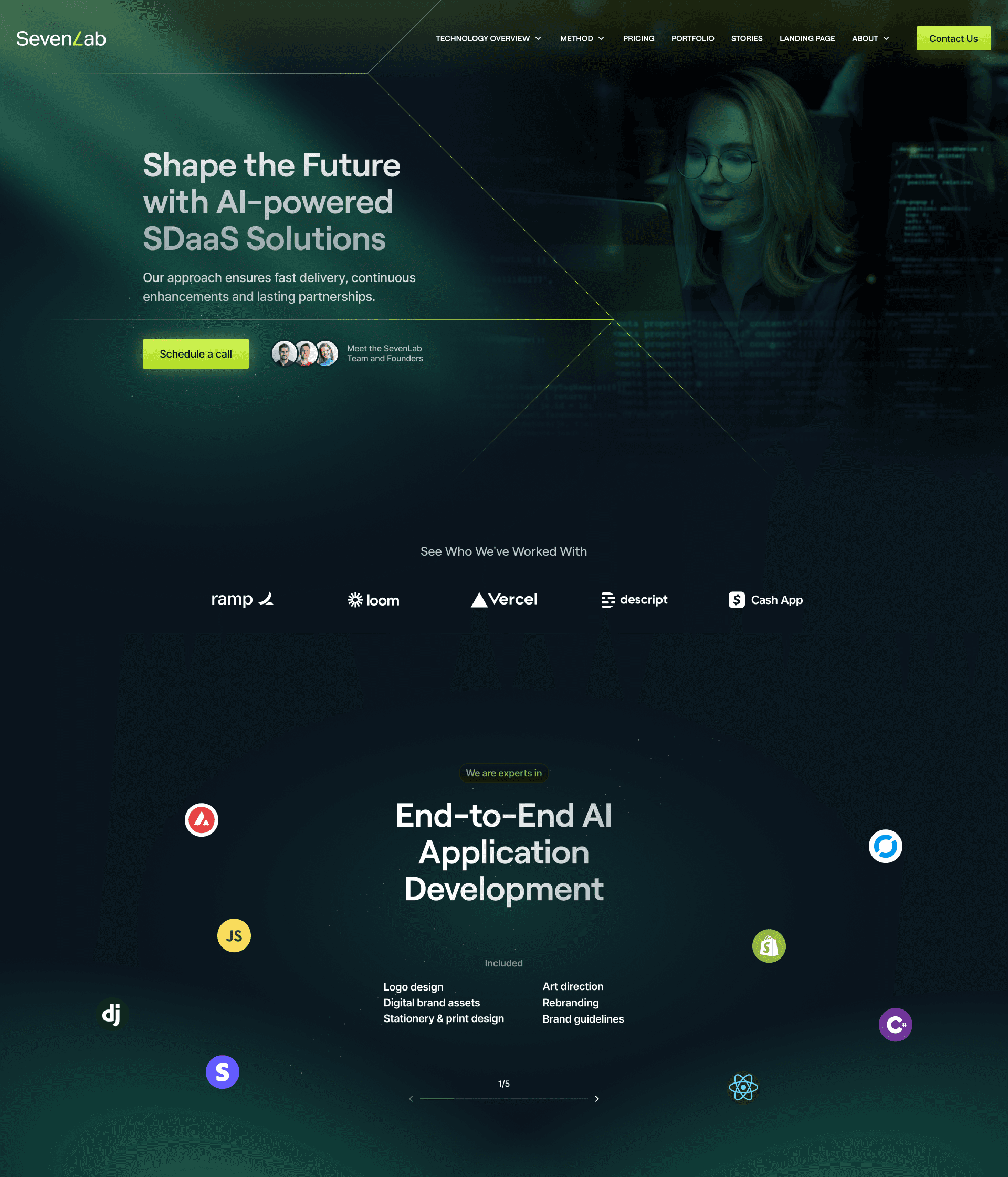

Ideation

Impact effort matrix

I conduct this exercise to understand the most impactful solution for the main issues. It helps me prioritize implementing solutions for a minimum viable product with low effort.

Outcome

It helped me to choose certain solutions to prioritize that will help me to start the product such as an investment tracker, customizable categories, goal-saving tracker, AI-based chatbox, and customizable reports.

Ideation

Impact effort matrix

I conduct this exercise to understand the most impactful solution for the main issues. It helps me prioritize implementing solutions for a minimum viable product with low effort.

Outcome

It helped me to choose certain solutions to prioritize that will help me to start the product such as an investment tracker, customizable categories, goal-saving tracker, AI-based chatbox, and customizable reports.

Ideation

Impact effort matrix

I conduct this exercise to understand the most impactful solution for the main issues. It helps me prioritize implementing solutions for a minimum viable product with low effort.

Outcome

It helped me to choose certain solutions to prioritize that will help me to start the product such as an investment tracker, customizable categories, goal-saving tracker, AI-based chatbox, and customizable reports.

Impact effort matrix

Design

Design

Design

User flow and data properties

Low-fi wireframes made in Balsamiq

UI Library

Hi-fi prototypes made in Figma

Reflection and Learnings

Overview

The experience of working on this project has been fantastic, and it has definitely helped me acquire new skills and upskill. Here are some of the main points to highlight.

Psychology of Money

Through this project, I learned a lot about the psychology of money and how people manage their finances. I also found some hidden problems that people face when trying to manage their money.

Responsive and consistent user experience

While designing this SaaS platform, I ensured that users would have a consistent and responsive experience whether they accessed it from a web browser or a mobile device. To achieve this, I meticulously created a design system, making sure that all components delivered a uniform experience across different devices.

Reflection and Learnings

Overview

The experience of working on this project has been fantastic, and it has definitely helped me acquire new skills and upskill. Here are some of the main points to highlight.

Psychology of Money

Through this project, I learned a lot about the psychology of money and how people manage their finances. I also found some hidden problems that people face when trying to manage their money.

Responsive and consistent user experience

While designing this SaaS platform, I ensured that users would have a consistent and responsive experience whether they accessed it from a web browser or a mobile device. To achieve this, I meticulously created a design system, making sure that all components delivered a uniform experience across different devices.

Reflection and Learnings

Overview

The experience of working on this project has been fantastic, and it has definitely helped me acquire new skills and upskill. Here are some of the main points to highlight.

Psychology of Money

Through this project, I learned a lot about the psychology of money and how people manage their finances. I also found some hidden problems that people face when trying to manage their money.

Responsive and consistent user experience

While designing this SaaS platform, I ensured that users would have a consistent and responsive experience whether they accessed it from a web browser or a mobile device. To achieve this, I meticulously created a design system, making sure that all components delivered a uniform experience across different devices.